“Rina will end up on your doorstep!”

That was the message my ex sent my mother when I left him. I was working two minimum-wage jobs, living in a tiny apartment, had full custody of our four kids with a ridiculously small child support payment, and he was living in our 5-bedroom family home.

He did his best to make his prophecy come true. But here I am today, running a successful business and helping others take back their power from their abusive exes.

If you're reading this newsletter, chances are you've experienced financial abuse too. In fact, when someone recently posted a poll in a Facebook group for victims of post-separation abuse asking about financial targeting, the results were stunning: Not a single person voted for "There was no financial abuse."

The invisible chains: three types of economic abuse

🔒 Economic control

🗡️ Economic exploitative behaviors

🚫 Employment sabotage.

Given that men earn significantly more than women, financial abuse is generally directed by men at women. And coercive controllers weaponize this in spades. So, if you’re a woman who was in a relationship with a male coercive controller, I’m betting that there’s a 99.99% chance (I made that statistic up but I’m sure of it) that you have been, and likely still are, a victim of financial abuse.

My ex constantly puts down my career choices and refuses to pull his weight with the kids because his career is more important than mine.

The myth of moving on

"Just move on," they say. "It's over now." If you've heard this from well-meaning friends, family, or even financial professionals, you know how frustrating it can be. These people assume that once the divorce papers are signed, you can skip off into the sunset, financially free from your abuser.

But here's the reality that these "experts" don't understand: When you have children with a financial abuser, divorce isn't the end—a new chapter of economic warfare is just starting. Think about it. Your ex now has:

📜 Court-sanctioned reasons to stay involved in your finances

💰 Legal leverage through child support and shared expenses

⚖️ Multiple opportunities to drain your resources through endless court battles

🐍 New ways to sabotage your financial stability while looking "reasonable" to the courts

My ex demanded joint custody but refused to take our medically fragile daughter to any of her hospital appointments, even during his parenting time. I had to do it and was off work so often that I lost my job.

One of my clients put it perfectly: "My ex doesn't care about spending $10,000 on lawyer fees if it means I have to spend $5,000 I don't have to defend myself." And here's what makes it even more insidious: The same financial warfare that was going on behind closed doors during your marriage is now happening through "legitimate" channels—courts, custody arrangements, and support payments.

The system isn't designed to recognize this form of abuse. When your ex withholds child support, the courts see it as a simple payment dispute. When they drag you back to court over minor issues, it's viewed as "exercising their legal rights." When they demand detailed accounting of every penny you spend on the children, it's labeled as "being financially responsible."

If my financial advisor hadn't been a friend who knew something of my experience, I’m not sure I could have spoken to her. I could be real and honest with her about my fears, and my lack of confidence.

But people like you and I, who’ve experienced, it know what it really is. It’s the same old pattern of control, just wearing a new mask. The good news? Once you understand this reality, you can start developing strategies to protect yourself. You can't stop your ex from playing these games, but you can get better at defending yourself against them.

My ex agrees to share the cost for something and then backtracks once I've paid it, making me fight for reimbursement, causing me stress and anguish. It's his way of saying he can still exert power over me because he knows I'm vulnerable financially.

13 ways your ex might be abusing you right now

Delaying or withholding support payments

Dragging out legal battles to drain your financial resources.

Using legal threats to intimidate you into accepting unfavorable settlements.

Failing to disclose assets or hiding money to reduce the amount owed to you in a divorce settlement.

Intentionally undervaluing shared assets or property to minimize your financial share.

Alternatively, refusing to reduce the price of a house or other asset so it won’t sell.

Refusing to do necessary repairs to a house so it won’t sell.

Contacting your employer to discredit you or cause trouble at your workplace.

Making it difficult for you to keep your job(s) by creating constant legal or personal disruptions.

Refusing to contribute to essential expenses for your children.

Using financial resources to manipulate custody arrangements.

Sending abusive or threatening messages related to money or financial obligations.

Using joint accounts or other financial ties (like a jointly-owned business) to stay in contact and exert pressure.

When my ex left, he told me "Tell me the truth. Who's gonna come live here?" I said no one and he asked how I was going to pay the rent.

Think back to your relationship. Did you:

Have to ask permission to buy basic necessities?

Hide small purchases to avoid conflict?

Get questioned about every penny you spent?

Have your spending mocked or criticized?

Lose access to bank accounts?

Get pressured to quit your job or change careers?

Have your credit ruined by your partner?

By the time you left, you were probably carrying deep financial trauma. Your money confidence muscle has been systematically weakened over the years, leaving you with huge issues about money.

I see this in my clients all the time. Brilliant women who freeze up when they need to make basic money decisions. Capable professionals who panic at the thought of checking their bank balance or their credit card statements. Successful businesswomen who feel guilty buying themselves a cup of coffee.

I’ve been there too. I recently came across this comment I wrote about three years ago.

My financial experiences in my childhood and in my marriage have left me with deep wounds and PTSD, and led me to develop unhealthy ways of dealing with financial issues. Every time I crush one of them, another one surfaces, as if I'm peeling several layers off a very moldy onion.

The main way this has manifested is in my "head-in-the-sand" approach to just about every aspect of my financial affairs. For instance, one of the essential aspects of my work as a freelance translator is invoicing. If I don't invoice my clients, I don't get paid. Yet, I used to put off my invoicing, sometimes for months, or until my clients literally begged me to invoice them, so that they could clear my payment from their books.

Even now, with the help of software that does the invoicing for me, I still have to force myself to do my invoicing, and it feels like there's a pit in my stomach when I start doing it at (hopefully) the beginning of every month. AND THIS IS SOMETHING THAT GIVES ME MONEY!!!!! Yes, I'm yelling here because it's so dumb.

It's literally like buying a lottery ticket and then stashing it in a drawer AFTER you hear you've got a winning number because the thought of actually claiming the prize is too scary. Anyway, I'm sure by now you can imagine how I feel when it comes to less pleasant financial aspects like taxes and bills.

Reclaiming your financial power

I’m happy to say that I’ve come a long way in the last three years. Invoicing is painless, I keep track of my bank statements, and by the end of last year, I’d calculated all my income and business expenses and was ready to file my taxes. It only took me one day to do this because I’m always on top of what’s going in and out, and I’ve got a system to track and classify everything. It takes me a maximum of 5 minutes a weekday.

The financial abuse triggered me so badly that I couldn’t talk about finances to my second husband or financial advisors. Getting EMDR therapy helped me overcome it

If I (world champion at being bad with money, according to my ex-husband) can get to this point, you can too. Think about this for a moment: You've already survived the worst of it. You got out. You're rebuilding. And just like I went from working two minimum wage jobs to running a successful business and being on top of my finances, you too can rebuild your financial confidence, one small step at a time.

Here are some strategies that have worked for me and my clients:

🌱 Start small, start safe

Set up a new bank account at a different bank from your ex

Create a simple system for tracking expenses (even if you only look at it once a week)

Use automatic payments for bills to reduce financial anxiety

Keep all receipts related to your children in one place

Document every financial interaction with your ex

🤝 Build your financial support team

Find a trauma-informed financial advisor who understands post-separation abuse

Connect with a high-conflict divorce coach who can help you navigate the system

Join support groups where you can share financial strategies with others who get it

Consider working with a therapist who specializes in financial trauma

🛡️ Create your financial safety net

Build an emergency fund, even if you can only save a few dollars at a time (getting into the habit of saving is more important than how much you save)

Keep detailed records of all shared expenses and communications about money

Learn about your legal rights regarding support and shared expenses

Develop multiple income streams if possible

Financial recovery isn't linear. You'll have good days and bad days. Some days, you might feel on top of your finances, and others, you might want to hide from your credit card statement. That's normal. What matters is that you keep moving forward, one small step at a time.

Want to know how I can help you?

If you're ready to break free from financial abuse and build a stronger future for yourself and your children, let's talk. Book a free 30-minute discovery call with me, and we'll explore how I can help you develop strategies to protect yourself and thrive.

And if you want to find out more about me…

Did someone forward this to you?

Resources

If you’ve got financial trauma and you’re terrified of money, I recommend these two books, written by women who’ve hit rock bottom and turned their financial situation round.

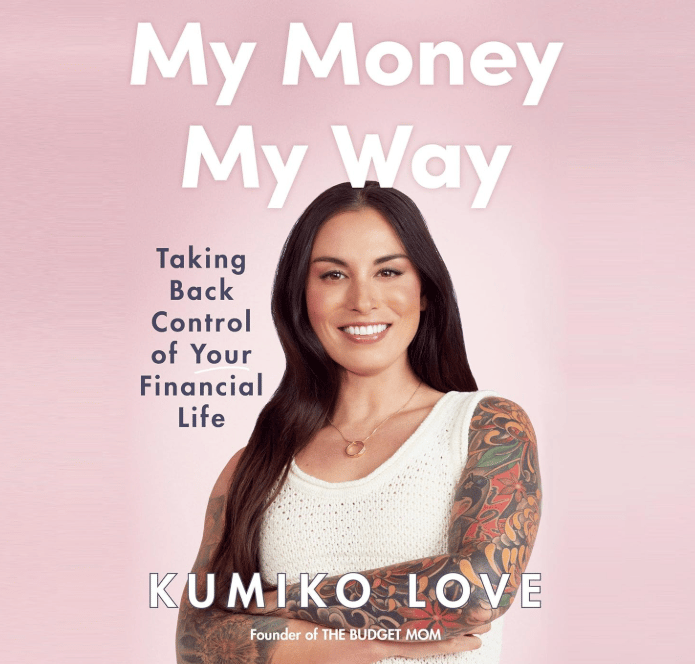

My Money My Way by Kumiko Love is the book that got me taking control of my finances. Kumiko is a single mother who designed a system for keeping track of her finances. She shares it in the book, along with practical strategies for building a healthy relationship with money after trauma.

What I love most about this book is that Kumiko gets it. She understands the emotional baggage that comes with financial struggles, especially as a single mom. She doesn't just throw budgeting advice at you; she helps you work through the mental blocks that keep you stuck in unhealthy money patterns. Plus, her system is flexible enough that you can adapt it to your own situation, whether you're dealing with irregular child support payments or rebuilding your credit after financial abuse.

I used Kumiko’s system on paper for nearly a year before recreating it in a tool called ClickUp that I also use for my business. If you want my ClickUp budgeting template, just reply to this newsletter asking me for it and I’ll send it to you.

If you want a no-nonsense guide to rebuilding your financial life, Tiffany "The Budgetnista" Aliche's Get Good with Money is a game-changer. I only came across it recently but I loved how it breaks things down and complements what I’ve learned from Kumiko Love. Also, Tiffany’s a master at metaphors, which makes for an entertaining read.

Tiffany lost everything in the 2008 recession—her savings, her house, her teaching career, and her credit score. While her situation wasn't caused by financial abuse, her journey back from financial trauma makes this book especially valuable for abuse survivors.

What makes this book different is how Tiffany breaks down complex financial concepts into manageable steps, perfect for when you're feeling overwhelmed by money decisions. She calls it becoming "financially whole", and it’s about way more than just budgeting. She describes how to build a complete financial foundation that no one can shake, exactly what you need when you're rebuilding after abuse.

The best part? Tiffany's voice throughout the book feels like that wise friend who's been there, made all the mistakes, and found a way forward. She doesn't judge, she doesn't shame, and she understands that everyone's starting from a different place. If your confidence around money has been shattered by financial abuse, this book can help you rebuild it, one small win at a time.